Good Friday Holiday Trading Schedule (2024)

From the CME Globex Control Center, here is the summary of KEY changes, per CME market segment Thursday March 28, 2024...

Hidden Force Flux is powered by our institutional-grade proprietary algorithm.

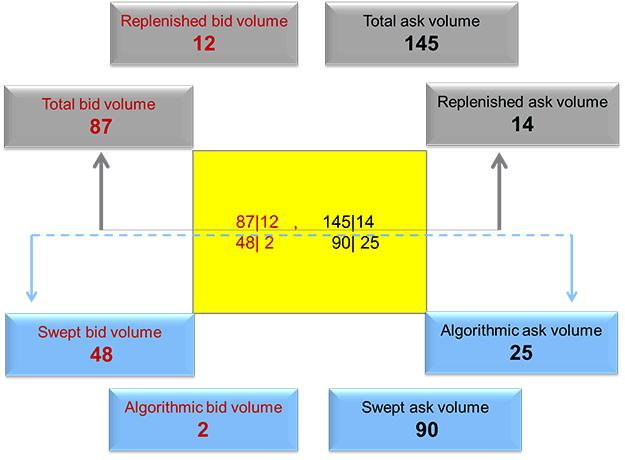

Replenished:

Swept:

Algorithmic:

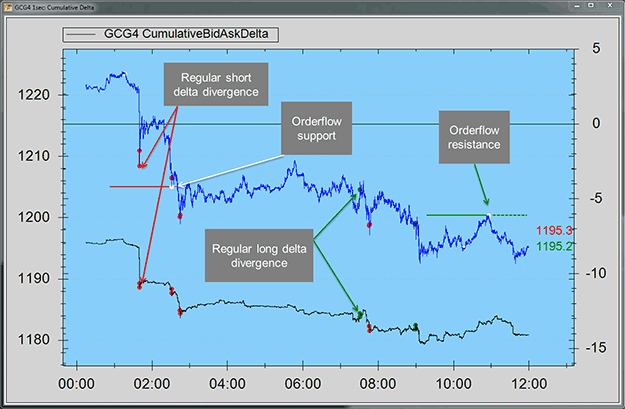

The concepts of ‘localized delta divergence’, ‘orderflow support/resistance’ are explained in Owner’s Manual which becomes available when you download and install the software.

Note: just to further clarify our concept of ‘localized delta divergence’ is different from the usual delta divergence you may be familiar with and is based on our proprietary computation.

Mar 27, 2024by AMP Futures

Feb 16, 2024by AMP Futures

Jan 29, 2024by AMP Futures