(updated 4pm - Sunday - May 10, 2020)

We have reinstated the Day Trade Margins for the Energies Complex during BOTH US Day and Overnight Session.

Here is the link to view DayTrade Margins for All Markets:

The risk of Negative Pricing is still present, for BOTH Crude Oil & Natural Gas (CME issued notice they are now prepared for Negative Pricing in Natural Gas).

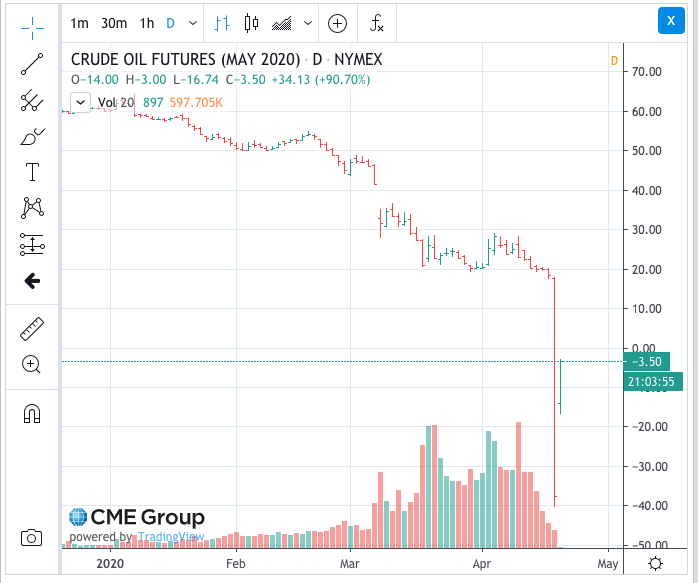

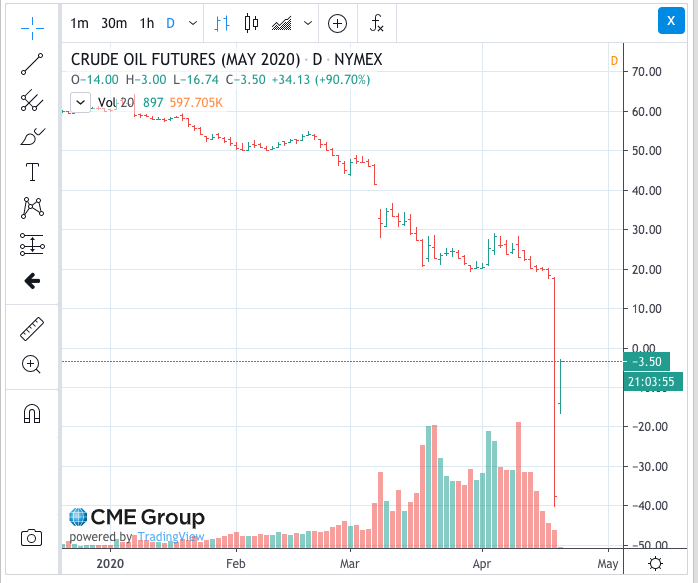

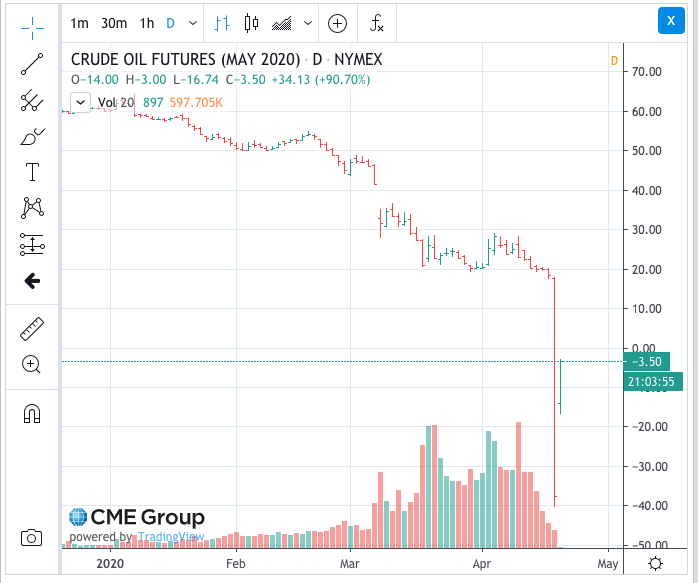

From what we experienced, when Crude Oil (CL) May 2020 Contract - Traded Negative for the 1st time in History...that the market conditions are not normal once prices traded negative. The orders we researched for our customers, were either REJECTED by CME due to Velocity Logic Circuit Breaker or were REJECTED due to not safe market conditions > NO BID - NO OFFER.

At this point, we were all at the mercy of the market, to help work orders for our customers to CLOSE their open Long positions or they were stuck long E-Mini Crude Oil that expired that day - which Settlement Price was -37.62.

We are taking the time to explain, because we want you to understand our logic, when setting these risk management rules below (From our experience, we do not want or ever want any of our customers to be in such an abnormal market condition).

We want our customers to be able to trade with normal Margins, so we are implementing these rule:

- If the market for Crude Oil trades at 10.00, (and you are LONG) we will attempt to close your OPEN Crude Oil position at the MARKET.

- If the market for Natural Gas trades at 1.000, (and you are LONG) we will attempt to close your OPEN Natural Gas position at the MARKET.

- All Energy Complex Markets - We require you to be FLAT (no open positions) - 5 days before Contract Expiration (including the CASH Settled E-Mini Contracts). If you do not roll or close your contract yourself, the risk desk will close your open position at the MARKET during the closing range of the final acceptable trading day (6th day before Contract Expiration).

VERY IMPORTANT - Your responsibility and Your Acceptance of the risk in trading during them extreme market conditions. You are solely responsible for any trading losses including if any debit balances are occurred. If you are stuck in an Open Position, you are at the mercy of the next available market price. By YOU placing orders - you are Fully Accepting this Risk. The above AMP Risk Crude Oil (10.00) and Natural Gas (1.000) Liquidation Trigger does NOT in any way guarantee against your trades generating negative balance. This is only a risk management tool to help our customers trade with normal Margins. Any trading PnL, both positive and negative, you are 100% responsible.

Another known risk is the market trades to the Crude Oil and Natural Gas Liquidation Trigger Price and AMP Risk closes your open position and the market does NOT continue to trade lower. This is out of our control, we do NOT know what the markets will do...we just need to have prudent risk management in order to allow normal Margins. If this happens, and you want to re-enter your position, you will need to wait until the market is back beyond the above Crude Oil (10.00) and Natural Gas (1.000) Liquidation Trigger Price.

If you do not accept this risk or these AMP Risk Management Rules, DO NOT PLACE ANY NEW TRADES.

--------------------------------------------------------------------------------------

(updated 1pm - April, 21, 2020

Due to certain anomalies affecting Crude Oil Futures have been set to Liquidating Trades Only. Any positions in CLM20 and QMM20, both long and short, are subject to liquidation..

This is an unprecedented times....YOU must trade responsible.

The event from yesterday could happen again...as of publishing this post, the June 2020 CL Contract is trading at 9.09. Within range of going negative again...and if happens again, this is unknown conditions and the ability to exit positions could become limited.

See Full Current Margins >

------------------------------------------------------------------------------------------------------------------

Due to Extreme Volatility and Unprecedented Market Events - Energies Markets Margins are currently set at 100% Exchange Maintenance Margins for both Day and Overnight Sessions.

See Full Current Margins >

Yesterday's Market Action for Crude Oil (CL) May 2020 Contract - Traded Negative for the 1st time in History. And it went Negative Price in a big way....Settlement Price -37.62 - for understanding, this is $37,620 market PnL / per contract from ZERO.

Even the at 100% Exchange Maintenance Margins, if long position...the Market PnL would be way beyond the margins requirements.

This is an unprecedented times....YOU must trade responsible.

The event from yesterday could happen again...as of publishing this post, the June 2020 CL Contract is trading at 15.78. Within range of going negative again...and if happens again, this is unknown conditions and the ability to exit positions could become limited.